8 things you need to know about tax reform

It could have been worse, but 2013 ushered in the most significant changes in the tax code for more than a decade.

For most American taxpayers, the resolution of the fiscal-cliff drama early last year was good news. The Bush-era tax cuts were made permanent for people in all but the top income-tax bracket; ditto for the low 15 percent tax rates on qualified dividends and capital gains. The deal even included a fix—of sorts—for the dreaded alternative minimum tax (AMT) that has annually threatened millions of taxpayers for years.

For wealthier taxpayers, however, the American Taxpayer Relief Act (ATRA) didn’t live up to its name. They now face higher marginal tax rates, new investment income taxes to finance the president’s health-care plan, and limitations on the itemized deductions they can claim. The combination of those policy changes will account for the bulk of the $600 billion in new tax revenue the government is expected to take in over the next 10 years as a result of ATRA.

“There were not a lot of big changes last year for middle-income taxpayers,” said Dustin Stamper, director of the Washington National Tax Office at Grant Thornton LLC. “The hit was primarily to high-income taxpayers.”

There are enough changes that taxpayers of all income levels are likely to find filing their returns more complicated this year. Here areeight of the biggest affecting 2013 returns.

1. Higher marginal rate

President Obama got his wish: Rich folks are going to pay a little more this year. In fact, they’re going to pay quite a bit more. The top marginal tax bracket for people making more than $400,000 annually ($450,000 for married couples) was upped to 39.6 percent. That’s still quite low from an historical perspective, but it’s the highest marginal rate since 2000. Add in the new 0.9 percent Medicare surtax on earned income over $200,000 and the top rate is over 40 percent. The income-tax rates on all earned income below the $400,000 threshold remain unchanged from 2012.

2. New Obamacare taxes

President Obama’s Affordable Care Act is being financed largely by two new taxes on wealthier Americans. The first is a new 0.9 percent Medicare surtax that applies to all earned income over $200,000 ($250,000 for married couples). On top of the 1.45 percent tax on income below that threshold, the combined Medicare tax on income above it will be 2.35 percent.

Taxpayers with more than $200,000 in annual gross income (AGI) are also subject to a 3.8 percent tax on investment income—which includes interest, dividends, capital gains, royalties and passive business income. The tax is not entirely straightforward. It’s levied on the lesser of an individual’s investment income or the amount that their AGI exceeds the $200,000 threshold—again, $250,000 for married couples.

If a single filer reports $210,000 in income—$50,000 of which is investment income—the 3.8 percent tax applies to the $10,000 above the threshold. If they make $300,000, it will apply to the $50,000 in investment income. “It’s a big topic of discussion with my clients,” said Rebecca Iacobellis, a CPA based in Staten Island, N.Y., whose client base includes a number of small-business owners. “The threshold amounts aren’t indexed for inflation, so it will start affecting more small-business owners going forward.”

(Read more: Common (and costly) tax mistakes to avoid)

3. Capital gains bite

The third big hit to wealthy taxpayers is an increase in the tax rate on qualified dividends and capital gains, from 15 percent to 20 percent for single taxpayers with AGI over $400,000. The rate remains 15 percent for taxpayers in lower tax brackets and 0 percent for taxpayers in the 10 percent and 15 percent income-tax brackets.

4. Limited deductions

After a three-year hiatus for wealthy taxpayers, the so-called Pease limitations—named after the Democratic congressman who introduced them in 1990—are back in force for the 2013 tax year. The rule limits the amount of itemized deductions that taxpayers with more than $250,000 in adjusted gross income ($300,000 for married couples) can claim on their tax returns. The limitation applies to things like mortgage interest, charitable contributions and state and local taxes but does not apply to items such as medical expenses, investment interest and casualty and theft losses.

Itemized deductions are reduced by 3 percent of the amount a taxpayer’s AGI exceeds the thresholds, up to a maximum of 80 percent of total deductions. For example, a married couple with $400,000 in combined AGI will have their itemized deductions reduced by $3,000 (3 percent of $100,000). “The Pease limitations were not in effect between 2010 and 2012, but they made a comeback last year,” said Stamper.

5. Lower medical-expense deductions

Another aspect of the Affordable Care Act will hit a wider range of taxpayers. Per ACA, the threshold for deducting medical expenses was raised from 7.5 percent of adjusted gross income to 10 percent. Taxpayers can now deduct only the cost of copays, insurance plan deductibles (both of which are generally rising), dental costs and other health-care expenses above 10 percent of their AGI. If you’re over the age of 65, the 7.5 percent rate applies until 2017.

“The idea is to limit the deductions taken by higher-income taxpayers, but this could apply to almost anyone,” said Iacobellis.

(Read more: How to keep the IRS auditors at bay)

6. The AMT fix

Higher-middle-income taxpayers no longer have to worry about an increasingly dysfunctional Congress agreeing on an annual “patch” for the alternative minimum tax. The tax was never indexed to inflation, and Congress has often waited perilously long to adjust the exemption amount to avoid millions more Americans having to pay it. As part of the ATRA, the exemption amount—$51,900 for 2013—is now indexed to inflation.

7. Home-office deduction

Another favorable change in 2013 is a standardized deduction for home-office expenses. Form 8829 is complicated enough that taxpayers were often getting into trouble claiming too much in deductions for home offices, said New York City–based CPA Vincent Cervone. They can now take a standard $5-per-square-foot deduction, up to 300 square feet, for a maximum deduction of $1,500 per month.

“This affects a lot of people,” said Cervone. “More Americans are filing Schedule C’s now, and 95 percent of those claim the home-office deduction.”

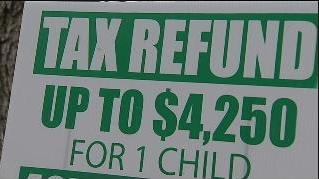

Here’s something to ponder: All 50 states regulate hair dressers, but only four—California, Oregon, Maryland and New York—specifically regulate tax preparers.

“The consequences of a bad tax return are much more serious than a bad haircut,” said Chi Chi Wu, staff attorney at the National Consumer Law Center.

How much do you know about the person you’ll pay to do your tax return? Are you sure, really sure, they’re qualified to do the job properly?

Your tax return is probably the single most important financial document in your life. It not only determines the size of your refund or how much you owe the government each year, but it’s often used to verify your income for many other important financial transactions, such as student loans, a home mortgage, alimony or child support payments and social welfare programs. So, you want it done right.

While certified public accountants are licensed and enrolled agents are credentialed by the IRS, the vast major of tax preparers in this country do not have to meet even minimum standards for education, training or competency.

A recent consumer law center report, “Riddled Returns,” analyzed years of mystery shopper testing by government agencies and consumer groups. The report concluded that the lack of regulation has allowed “widespread abuses” by paid tax preparers, which hurt both their clients and the U.S. Treasury.

(Read more: How to get free help with taxes)

“We found incompetence and outright fraud,” Wu said. “And it wasn’t just a few bad actors. We saw this over and over again.”

David Rothstein, director of research and public affairs at the Neighborhood Housing Services of Greater Cleveland, would like to see all tax preparers regulated. His organization does mystery shopping at storefront tax preparation services.

“We’ve seen a lot of people told not to report cash income because it will lessen their refunds,” Rothstein said. “Or they’re told, ‘Come to us and we’ll get you a bigger refund than the other guys.’ Obviously, if they’re doing it correctly, you should get the same refund no matter where you go.”

The National Association of Tax Professionals, the largest trade group for tax preparers in the U.S., supports federal regulation.

“Oversight is not a bad thing. Regulation is not a bad thing,” said Cindy Hockenberry, who manages the association’s Knowledge Center. “There are so many industries that require licensing, why not the tax preparation industry? You’re dealing with people’s finances, and the penalties for doing things wrong are pretty steep.”

In 2011, the IRS proposed regulations to require professional tax preparers to register, pay an annual fee, pass a competency exam and meet continuing education requirements.

(Read more: Common (and costly) tax mistakes to avoid)

But the IRS program never got off the ground. Three independent tax preparers sued (Loving v IRS) and won. A federal court ruled the IRS does not have the authority to license tax professionals. The case is now on appeal.

The Institute for Justice, which calls itself the nation’s only “libertarian, civil liberties, public interest” law firm, filed that lawsuit. Attorney Dan Albin, who handled the case against the IRS, thinks the choice of a tax preparer is best made by the consumer without any governmental interference.

“We believe the taxpayer, not the IRS, should be the one who decides who prepares their taxes,” Albin said. “We’re opposed to any requirement that you obtain a license from the government in order to prepare taxes.”

Albin said tax preparers are already regulated in lots of ways, and the institute does not oppose laws relating to tax fraud or malfeasance.

“These are simply protectionist regulations that are designed to help big business,” he said, which would put many mom-and-pop preparers out of business.

Robin McKinney, director of the Maryland CASH Campaign (Creating Assets, Savings and Hope), doesn’t think it’s a bad thing if unqualified tax preparers are driven out of the marketplace. That’s why she helped get Maryland’s tax preparer law passed in 2008.

“There needs to be more accountability built into the system,” McKinney said. “When you pay someone else to do your return, you assume they know what they’re doing. The companies that are doing the right thing want regulations to lift the industry’s standards.”

(Read more: 7 triggers for the alternative minimum tax)

McKinney wants everyone to remember that when you sign that return you are telling the government it’s correct, even if you didn’t prepare it yourself. If the return is wrong, you could face an audit, civil penalties or even criminal charges.

“You shouldn’t just be able to hang out a sign and call yourself a tax preparer,” she said.

The IRS has helpful information on how to choose a professional tax preparer on its website.

CNBC contributor Herb Weisbaum is The ConsumerMan. Follow him on Facebook and

or visit The ConsumerMan website.

For those of you serious about solving your IRS problems or making sure you are not audited, please contact us at 713-774-4467 or go to www.taxproblem.org